|

I SPENT MORE THAN 40 YEARS in the trenches advising growing businesses and their investors as a lawyer but also making angel investments and serving on a few company boards. I also served in senior management of a couple of law firms, including one with more than 1,000 professionals and offices across the country. During the same period, I co-founded what is now the oldest and largest trade association for venture capital and private equity investment firms in the Southeast and wrote a few books on deal making and legal strategies for business operators.

Hopefully, I have learned a few things that are not in the law books. Things about how the law and business can intersect effectively and creatively to the business operator's advantage. Things about how investors think and deals are negotiated. I hope the perspective I have gained and our interaction can help you avoid common entrepreneurial pitfalls and make me a more effective counselor. And, I hope we can have a lively discussion where we learn from one another. For instance, when does it make sense to consider venture capital as a financing alternative? And, when you seek venture capital, how do you go about it effectively? How should you deal with angel investors, particularly when they are family? If you are just starting, what kind of business form should you adopt? And, how should you allocate ownership among the founders? There are hundreds of these questions and few absolute answers that apply to every situation. So let's start with founder ownership for an emerging growth company, which for us will mean a company established with ambitious growth expectations that will likely need invested capital to sustain its growth. Let's say you have two founders, each with an important role in getting the company started and building its foundation for long term growth. Each is prepared to invest a similar amount to get things started. The right thing to do is give them equal shareholdings and seats on your board. Right? If you answered yes, you may be making your first big and potentially costly mistake. Between yourselves, you probably know who the driver of the new business is, the one who came up with the idea and has a real passion to make it succeed. You probably know who will be working the longer hours to get the business started and who is and will be otherwise contributing more in other ways. Try to recognize the opportunity driver from these factors and make sure the driver gets more of the stock and more rights on the board. First, it will assure you of having a person who can make decisions if there is a disagreement. Deadlock preserves the status quo which can be deadly in a new business that needs to innovate and respond quickly to survive. Second, it will force you to declare a leader and flesh out whether there are issues about who should lead and who should follow in the business. And, while you are at it, make sure you have a shareholders agreement and that ownership rights vest over time so that if a partner does not fulfill his or her anticipated future contribution, or worse, leaves the company, you can get back ownership from the non-contributing partner. Outside investors will expect management vesting of stock, so you might as well put it in place on your terms. Image (c) 2006. Galapagos scene. A FRIEND, SUCCESSFUL ENTREPRENEUR AND now advisor to a leading tech incubator asked my opinion about an online forms provider that promises to incorporate your business and give you and file the organizational forms, stock plans and restricted stock agreements you need for a modest fixed fee.

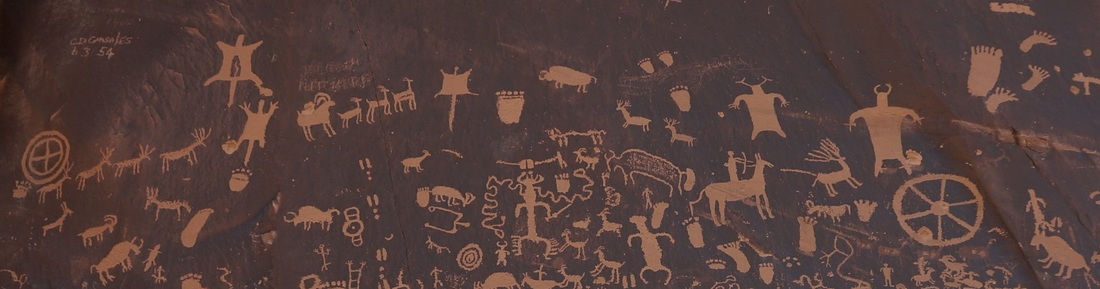

Should you use such a service when you form your new company? Does the online service site provide a budding entrepreneurial team with what it needs to get started? If you use the site, should you have a qualified attorney review the paperwork before it is signed and filed? Are there risks to using such a site that new entrepreneurs should be wary of? Of course, the knee jerk reaction of any lawyer who has advised entrepreneurial clients for a career is probably going to be negative. After all, the service web site is careful to acknowledge that it is not providing legal services while, at the same time, touting the "we have provided legal advise to start up for years" aspects of their founders and advisors backgrounds. No mention is made of tax or accounting issues at all, which can be important in choosing an entity for a business. But is there value in the service? And, can you use it confidently in forming a new company and dividing up the initial equity round? The answer is a qualified yes, if you are comfortable in accepting the choices made by the service to incorporate you in Delaware in a C corporation. Of course, that's a big "if" and you still have to make critical decisions about how to divide up the ownership of the company. The restricted stock documentation is a good idea, and available on the site I reviewed, for a number of reasons but shouldn't you get some counsel on the alternatives and mechanics? The particular site I reviewed offered incorporation in Delaware, form bylaws and initial minutes to form the company and issue the initial stock. I assume it included standard stock forms to fill in. It also offered restricted stock agreements and invention secrecy and assignment agreement forms as well as related board consents, all important stuff when you are starting out. I think you might save a few bucks with a site like this without compromising the future of your business if you engage a qualified lawyer to help you evaluate the decisions you are making by using the documents. The site reviewed was open to lawyer involvement (without charge) and allowed revisions to be made to the documents. Use the lawyer for what lawyers do best, helping you make decisions about type of form to select, using equity to incentivize performance, protecting intellectual property, and understanding the tax consequences of you decisions. Then if your plan for formation fits the model promoted by the site, use their documents with a quick review by your lawyer to take care of the mechanics. And, while you are at it start a relationship with a good accountant. Numbers and the planning that accompanies numbers are going be very important going forward. More of a risk taker? Then you might just use the service after getting agreement from your formation team and informal advisors, if you have them. Do your best and pour your efforts and limited resources into testing whether your idea has legs. If it does, you can revisit the decisions on formation that you made then. But one caveat. If you are going this alone, you might consider starting with a single member LLC agreement instead. It's easy to prepare, gives you a flow through organization (so you can write off losses to your personal tax return) and creates a see-through entity that merges into your personal tax return as long as you only have one owner. You can then revisit the organizational form later when you add parties or raise money. Of course, you'll want to check with your lawyer or accountant about that. Photo copyright 2016 from Newspaper Rock in Canyonland National Park.  5th edition of the second book. 5th edition of the second book. WE WERE ON A PLANE RETURNING TO ATLANTA after closing an acquisition for a client in Texas. It was 1985 and I was a young partner in a business law firm sitting next to my boss in first class. He was catching up on the day's news in the aisle seat and I was reviewing a draft of a manuscript I was working on for an entrepreneur's guide to the terms and deal points commonly negotiated in venture capital transactions. When he finished his paper he looked over at what I was doing and snatched the manuscript. He wasn't much for conversation. "What are you doing?" he said. "Working on a book I hope to publish." He took a sip from his drink and then flipped through the manuscript, tossing it back to me when he was finished. I expected a comment, maybe some encouragement, but instead he got out of his seat and headed to the toilet. Half way there, he stopped and turned around. Looking me straight in the eye and with a voice that could be heard by everyone, he shook his head and proclaimed "that's the dumbest f*!#ing idea I ever heard of." And then he turned around and walked to the bathroom. If I was wavering in my resolve to complete the manuscript or face the gauntlet of publisher submissions and rejections, this was now my great motivation. No way in the world was I going to give my boss the satisfaction of my failing in this endeavor. No matter how long a shot this was, somehow, someway it was going to succeed. You know the rest of the story if you read my earlier posting called "I can't possibly know anything about venture capital." The book published as The Venture Magazine Complete Guide to Venture Capital in 1987 and sold out quickly. Since then, we have published four additional editions under the Growth Company Guide moniker. The Guides, available through Amazon.com, have been in print now for nearly three decades. Entrepreneurs and angel investors have used the books, as have business schools and business accelerators. U.S. and European venture funds have used them to train associates and in help with planning. Even the Soviet Union purchased case quantities for their business training courses during Glasnost. If you are curious, here's what readers have had to say about the book. So, what's the point of the story? And, what does my personal publication story have to do with entrepreneurs or growing businesses? Two things, actually. First, other people are going to routinely misunderstand or under appreciate your entrepreneurial efforts. My boss was an accomplished lawyer who had negotiated numerous deals. Even so, he could not see the value in what I was doing. Second, it's only a dumb idea until you prove it isn't. Once you succeed, many of your greatest detractors will remember themselves as proponents. Many will wish they had the gumption and patience you had to strike out and make something new happen. Some will want to emulate you. That's what happened to me. Just months after publication of the book was announced, the boss man stopped by my office to let me know he had secured a contract to write a treatise on corporate law. He was going to assign lawyers in the firm to write the chapters and I was going to organize the effort and ghost write his book. Now that was the dumbest idea I ever heard of. I was polite. I didn't express an opinion. I just said no. I was too busy following up on my own dumb idea to help him with his. TODAY'S ENTRY BORROWS the title of Paul Bogard's intriguing book (Back Bay Books 2013) and extends the break from talking exclusively about the mechanics and art of dealing with the issues of starting a high octane business and raising the money needed to fuel its ascent.

As Paul's book notes, most of the contiguous 48 States of the United States and Europe are enveloped by a fog of artificial light that blocks out the thousands of stars otherwise visible to the naked eye. In many cities, fewer than 25 stars can be seen on an average night. In a thorough and thoughtful book, Paul makes a case that this impacts our lives in ways we do not fully appreciate and blinds us to the wonder of the unadulterated night sky, diminishing out lives in the process. On a recent Spring trip, I took the opportunity to visit some Western National Parks where the night sky remains dark and largely free of the artificial light that fogs much of the rest of our country. While there, I ventured out into the late night sky on several occasions to reacquaint myself with the night sky that still shown brightly in my suburban 1950s childhood. I recommend the book and the experience if you can work it into your schedule. I joined my effort to visit the night sky with my passion for photography. I found it to be well worth the effort. It was invigorating and, frankly, awe inspiring. You might think about revisiting the night sky sometime in your near future. It might just fill you with a sense of wonder. By the way, the National Park Service estimates that you can see more than 2,500 stars from Arches National Park. That's 100 times as many stars as you might see from your city. The photo is just a small sample of the full sky. Photo copyright 2016 Clinton Richardson. Arches National Park at night. YOU KNOW THE REST OF the saying . . . . And in the spirit of the saying, we take a Spring break from our postings and offer, instead, these photos from a recent trip. We hope this helps you recharge a bit as you enter the work week. All photos copyright 2016 Clinton Richardson.

|

the blog

Travel, history, and business with original photos.

your hostClinton Richardson - author, photographer, business advisor, traveler. Categories

All

Archives

July 2023

Follow us on Facebook

|

Check out Ancient Selfies a 2017 International Book Awards Finalist in History and 2018 eLit Awards Gold Medal Winner and

Passports in his Underpants - A Planet Friendly Photo Safari a 2020 Readers' Favorite Winner in Nonfiction

Site Copyright 2024 by Clinton Richardson

RSS Feed

RSS Feed