|

A RECENTLY OVERHEARD discussion between a six year old and his mom:

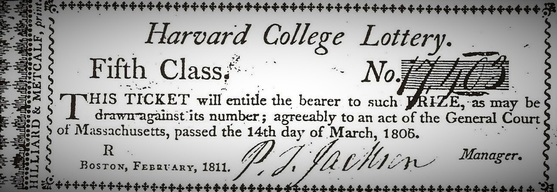

Mom: Son, we are going to buy a lottery ticket. Boy: Why would we do that? Mom: Well, if we win we will get lots of money. Boy: But, we already have money. Mom: We could buy new cars! Boy: We already have cars. Mom: We could buy a beach house. Boy: We already go to the beach. Mom: We could buy a house in the mountains. Boy: We already have a house. How could we live in three houses? This should go on the boy's resume later when he starts his own business and has to raise capital for expansion. This is someone who will look to his company's real needs when projecting how much money he needs to raise. He won't want to sell more stock than he needs to by inflating the amount he raises to include non-essential purchases. Granted, there is art involved in determining how much money a growing company needs to raise. There are variables and the future is never easy to predict. And, there is some truth in the adage that you should raise as much as you can because markets and appetites for venture investing change. But there is also evidence from earlier venture successes that staging fund raises to defer some investment until the more mature company can demand higher valuations can reduce the amount of equity a company sells to grow its business. Equity not sold is ownership retained by founders and management. The underlying attitude displayed by the boy in the conversation above is a good place to start. Image courtesy of Wikipedia, GNU Free Documentation License. The venture moola blog comes to you from Atlanta, Georgia. Find it at readjanus.com. Copyright Clinton Richardson.

Comments are closed.

|

the blog

Travel, history, and business with original photos.

your hostClinton Richardson - author, photographer, business advisor, traveler. Categories

All

Archives

July 2023

Follow us on Facebook

|

Check out Ancient Selfies a 2017 International Book Awards Finalist in History and 2018 eLit Awards Gold Medal Winner and

Passports in his Underpants - A Planet Friendly Photo Safari a 2020 Readers' Favorite Winner in Nonfiction

Site Copyright 2024 by Clinton Richardson

RSS Feed

RSS Feed